Projects

Full-Funnel Amazon Ads System ($5M+ / Month)

Enterprise strategy across SP, SB, SD, and DSP with a balance of growth vs efficiency using TACoS, rank signals, and incrementality.

- Budget allocation by funnel stage + lifecycle

- SQPR-led market analysis and keyword mapping

- LTV-driven TACoS planning and rank defense

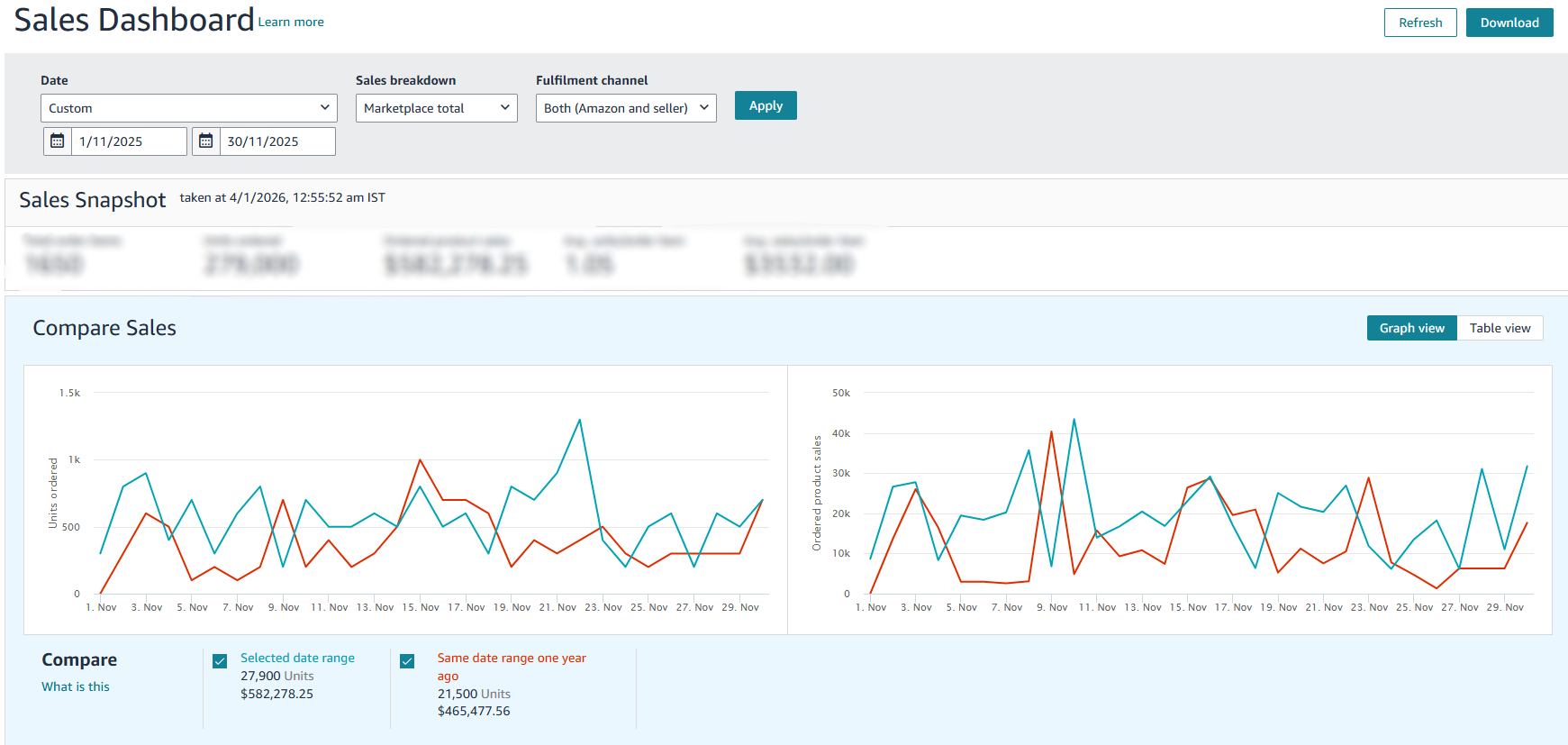

Year-over-Year Growth via Full-Funnel Restructuring

Drove year-over-year growth by restructuring the Amazon Ads funnel to focus on incremental demand, efficiency at scale, and long-term rank signals — not short-term ROAS inflation.

- SQPR-led market analysis to identify scalable non-branded demand

- Reduced over-dependence on branded spend

- Reallocated budgets toward rank-driving and NTB keywords

- Custom reporting to isolate waste and improve incrementality

- Improved NTB contribution without sacrificing TACoS discipline

YoY comparison from Seller Central showing growth driven by full-funnel strategy restructuring.

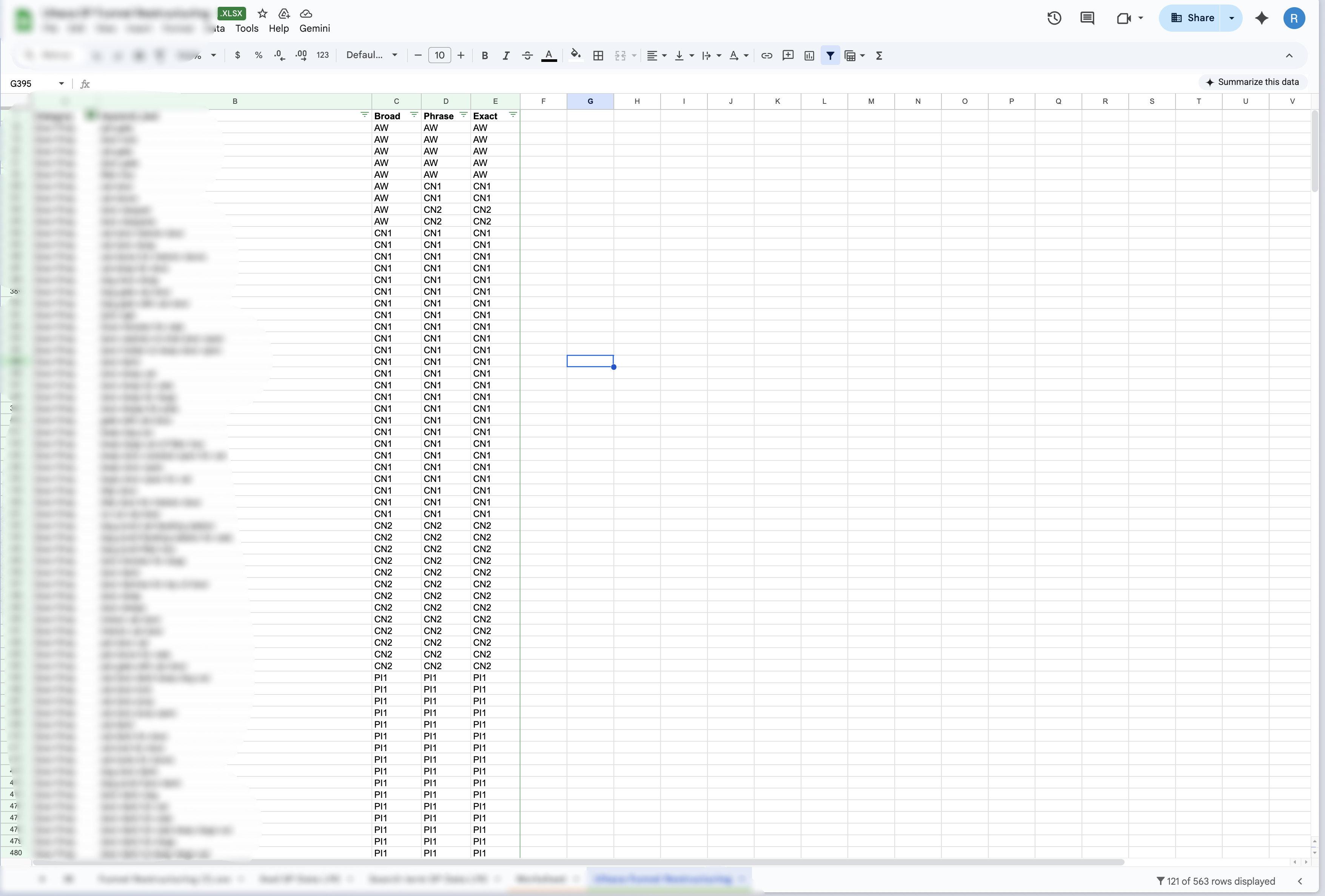

SQPR → Funnel Mapping

Built funnel structure directly from SQPR performance signals. High CVR keywords were treated as Purchase Intent, while high-CTR, lower-CVR keywords were classified as Consideration. This removed guesswork from campaign design and allowed budgets to be allocated by intent, not volume.

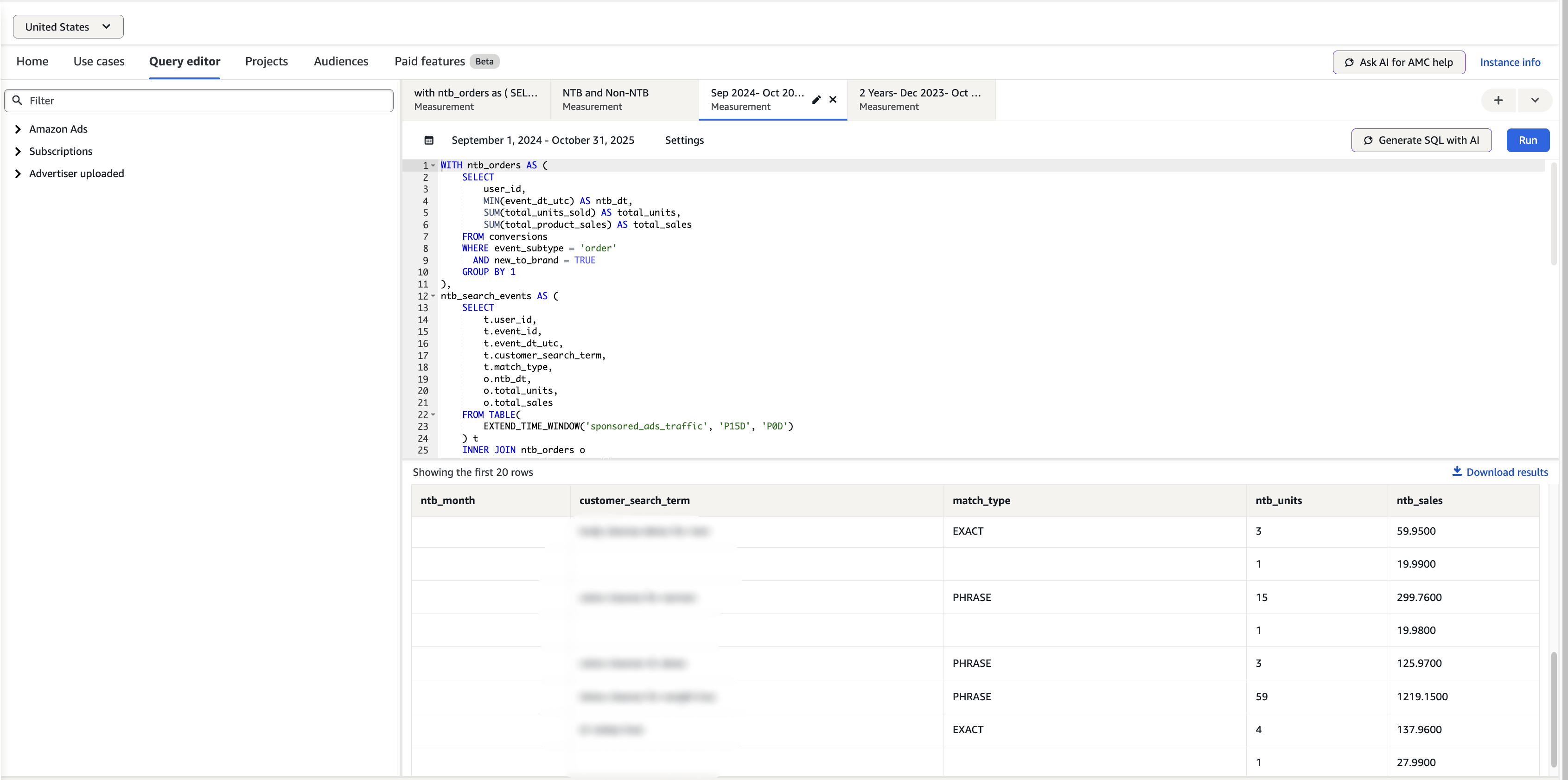

AMC Measurement: Keyword-Level New-to-Brand Attribution

Built a custom AMC query to attribute New-to-Brand (NTB) orders and sales at the keyword and match-type level — enabling acquisition analysis not available in Amazon’s native reporting.

- Custom SQL in AMC Query Editor to isolate NTB orders and sales

- Mapped NTB performance by search term, keyword, and match type

- Identified high-acquisition keywords vs repeat/loyalty-heavy terms

- Justified higher TACoS where acquisition was incremental

- Reallocated budget away from low-incrementality keywords despite strong ROAS

AMC Query Editor output — keyword-level New-to-Brand attribution (custom query).

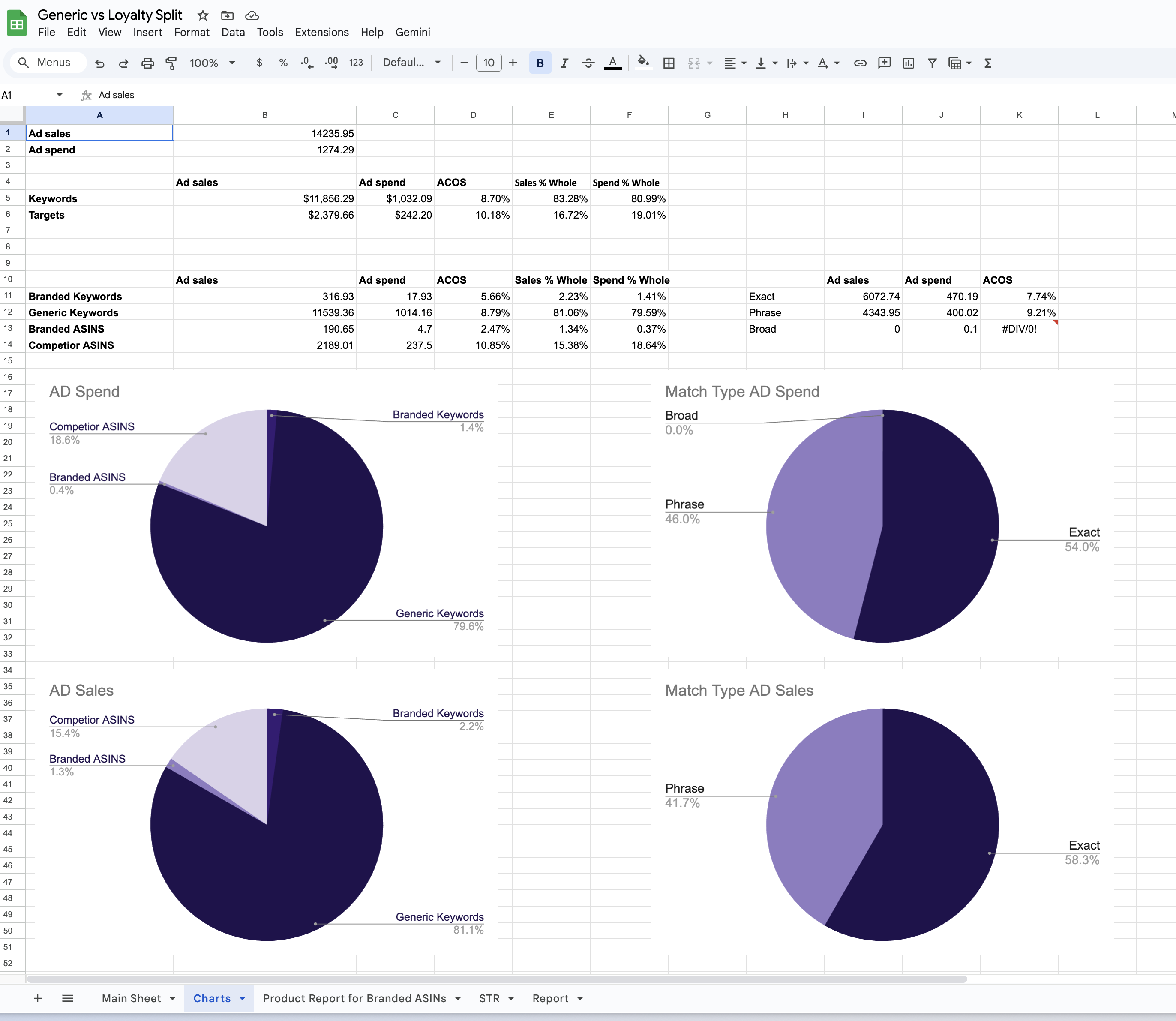

Branded vs Generic Spend Control

Built reporting to separate branded, generic, competitor, and target traffic, reducing ROAS inflation and reallocating spend to incremental demand capture.

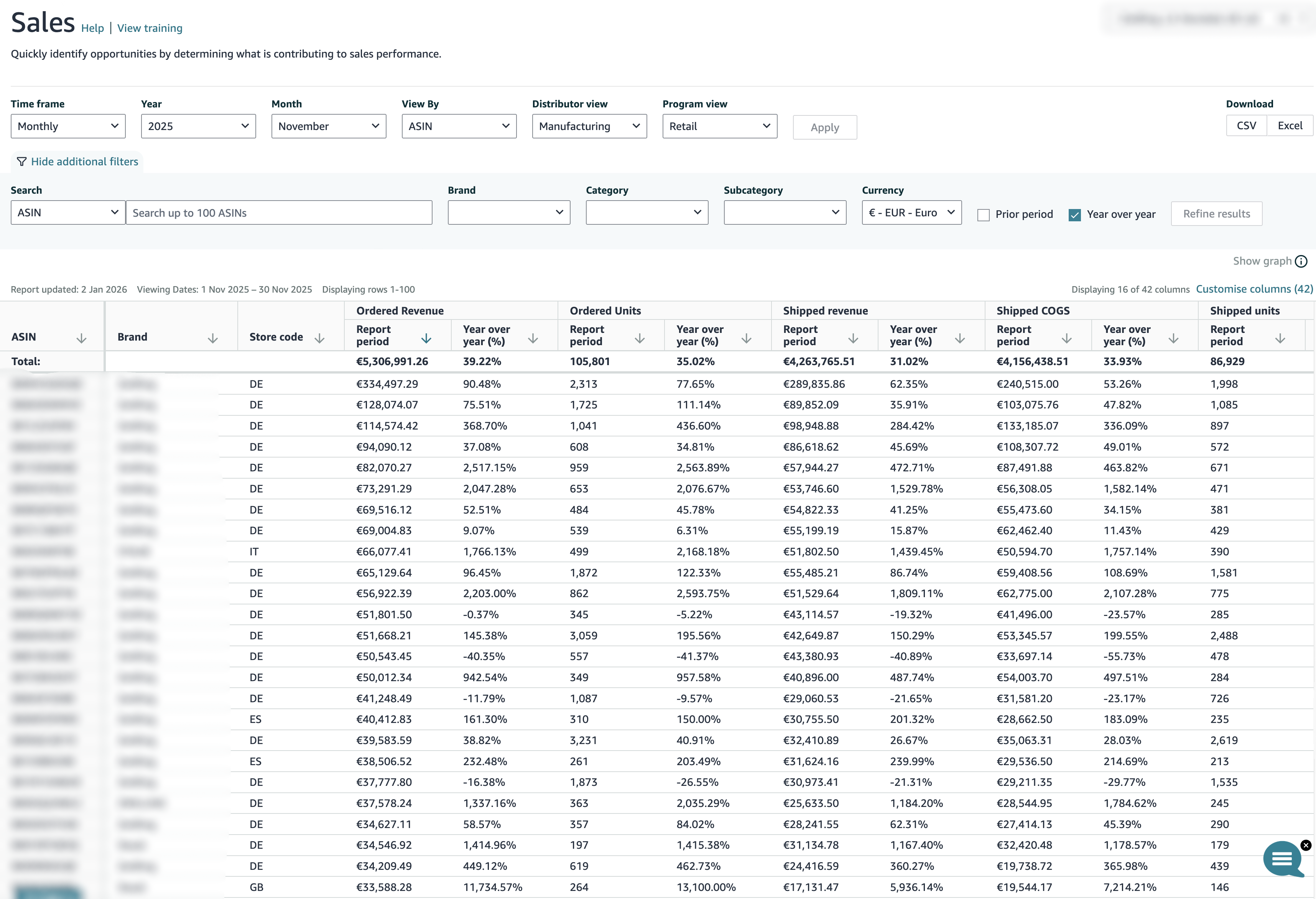

Vendor Central & EU Marketplace Economics

Managed Vendor Central performance across EU marketplaces with a focus on COGS-based growth — the only metric that reflects true brand revenue. Amazon retail prices fluctuate independently and do not represent brand-side profitability.

- Tracked year-over-year growth using COGS, not shipped revenue

- Analyzed ASIN-level performance across EU marketplaces

- Balanced demand growth with contribution margin protection

- Evaluated performance independent of Amazon’s retail price changes

Result: 31%+ year-over-year growth in COGS, representing true brand-side growth.

Vendor Central ASIN-level YoY view — performance evaluated on COGS, not Amazon retail pricing.

A+ Content & Brand Store Systems (Conversion & Rank Support)

Built A+ Content and Amazon Brand Store experiences designed to improve paid-traffic conversion, reduce bounce, and reinforce relevance signals that support organic rank growth.

Deliverables

- A+ layout planning (desktop + mobile)

- Benefit-led module sequencing for high-intent landings

- Brand story + comparison module planning

- Amazon Brand Store page structure and navigation

What it supports

- Higher CVR from SP/SB/SD/DSP landings

- Storefront journeys for Sponsored Brands

- Lower bounce from paid traffic

- Relevance reinforcement for organic rank

D2C Website Design & Growth Infrastructure (Shopify)

Designed, built, and launched a Shopify-based B2C website end-to-end to support direct sales, SEO discovery, and brand credibility beyond Amazon.

Deliverables

- Shopify store setup and configuration

- Site architecture, navigation, and collections

- Product creation, merchandising, and PDP setup

- Checkout and storefront UX optimization

SEO & growth foundation

- Keyword research for brand + category intent

- On-page SEO (titles, meta, headers, internal links)

- Crawlable structure and clean URLs

- Conversion-focused page structure and trust signals

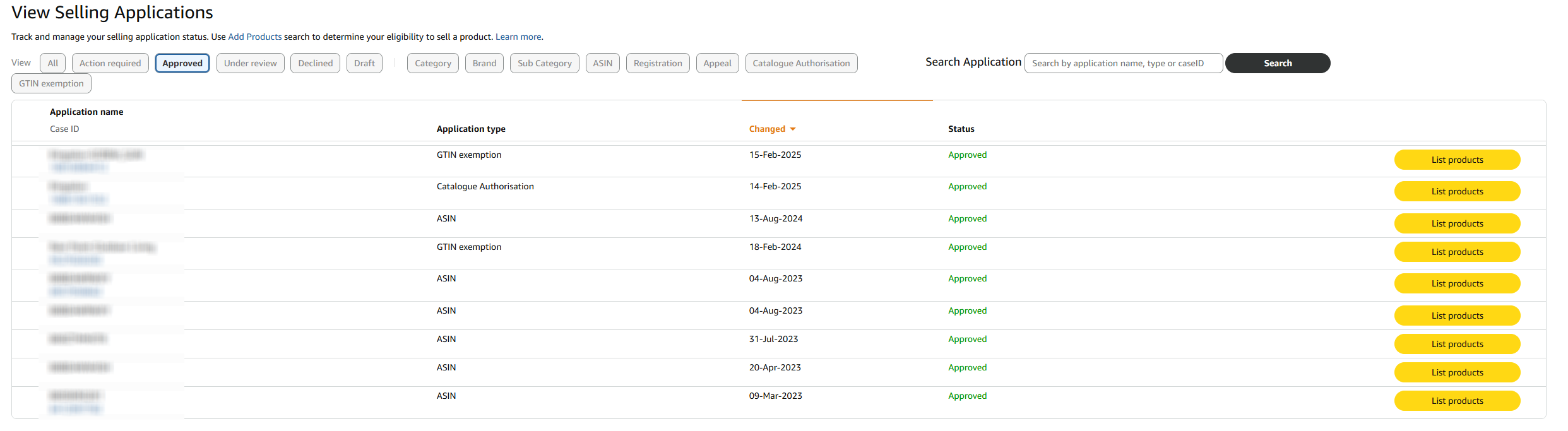

Catalog Access, Compliance & Listing Recovery

Owned Seller Central “Selling Applications” workflows to secure listing eligibility — including GTIN exemptions, ASIN approvals, catalog authorizations, and policy-aligned appeals. Executed deeply at Agromato and repeated across other brands.

What I owned

- GTIN exemption applications and documentation

- ASIN approvals for restricted listings

- Catalog authorisation case handling

- Appeal drafting aligned with Amazon policy language

- Diagnosis + resubmissions (docs, attributes, policy gaps)

Why it matters

- Prevents launch delays and listing downtime

- Protects revenue continuity

- Ensures ASINs remain eligible for advertising

- Reduces operational risk during scale